◎欢迎参与讨论,请在这里发表您的看法、交流您的观点。

机构投资者控制了应用光电公司(纳斯达克股票代码:AAOI)52%的股份,并在股票上涨18%后于上周获得了回报

Key Insights

A look at the shareholders of Applied Optoelectronics, Inc. (NASDAQ:AAOI) can tell us which group is most powerful. With 52% stake, institutions possess the maximum shares in the company. Put another way, the group faces the maximum upside potential (or downside risk).

Last week's 18% gain means that institutional investors were on the positive end of the spectrum even as the company has shown strong longer-term trends. The gains from last week would have further boosted the one-year return to shareholders which currently stand at 611%.

Let's delve deeper into each type of owner of Applied Optoelectronics, beginning with the chart below.

NasdaqGM:AAOI Ownership Breakdown February 5th 2024

What Does The Institutional Ownership Tell Us About Applied Optoelectronics?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

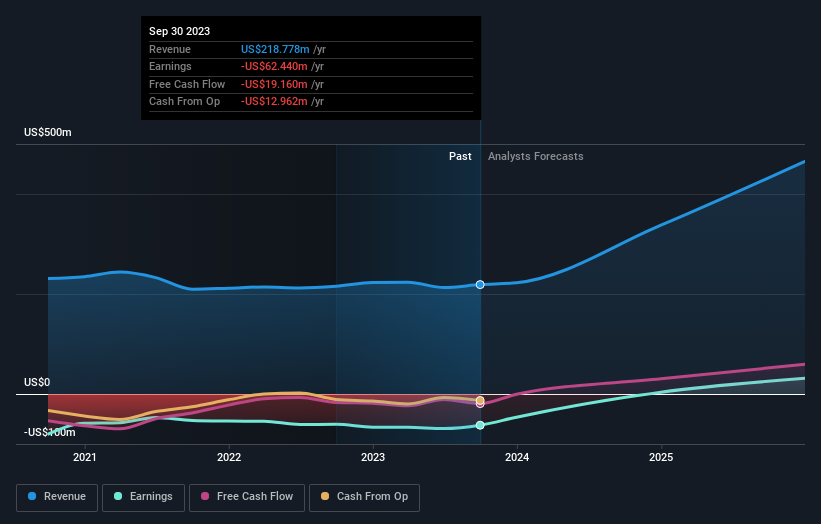

We can see that Applied Optoelectronics does have institutional investors; and they hold a good portion of the company's stock. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Applied Optoelectronics' earnings history below. Of course, the future is what really matters.

NasdaqGM:AAOI Earnings and Revenue Growth February 5th 2024

Since institutional investors own more than half the issued stock, the board will likely have to pay attention to their preferences. Hedge funds don't have many shares in Applied Optoelectronics. The company's largest shareholder is Hood River Capital Management LLC, with ownership of 4.2%. Meanwhile, the second and third largest shareholders, hold 3.8% and 3.6%, of the shares outstanding, respectively. Additionally, the company's CEO Chih-Hsiang Lin directly holds 2.0% of the total shares outstanding.

On studying our ownership data, we found that 25 of the top shareholders collectively own less than 50% of the share register, implying that no single individual has a majority interest.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

Insider Ownership Of Applied Optoelectronics

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

We can see that insiders own shares in Applied Optoelectronics, Inc.. It has a market capitalization of just US$678m, and insiders have US$31m worth of shares, in their own names. This shows at least some alignment. You can click here to see if those insiders have been buying or selling.

General Public Ownership

The general public-- including retail investors -- own 44% stake in the company, and hence can't easily be ignored. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Applied Optoelectronics better, we need to consider many other factors. Be aware that Applied Optoelectronics is showing 2 warning signs in our investment analysis , and 1 of those doesn't sit too well with us...

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

非特殊说明,本文版权归 玩球体育自媒体 所有,转载请注明出处.

本文分类: 网络热点

本文标题: 机构投资者控制了应用光电公司(纳斯达克股票代码:AAOI)52%的股份,并在股票上涨18%后于上周获得了回报